Yes. Our Mobile Banking app with Remote Deposit operates in a secure, encrypted environment. You’ll need to log in with your User ID and password, as you would when using our Online Banking. Not yet signed up for Online Banking? No worries. Sign up here.

Online Banking

Use our free online Online Banking service to securely manage your Rancho Federal accounts. To enroll in Online Banking, simply click the Online Banking button above, then click register and follow the prompts. Current users can simply click the Online Banking button above, and enter your user name and password. It’s that simple to take advantage of these time-saving features, quickly and securely:

- View your account balances, debit card transactions and deposit history

- Make loan payments and view loan information

- Print cleared checks

- Place stop payments on checks

- Transfer funds between UFCW CU accounts

- Order checks through Harland Clarke

- Apply for a loan and receive a decision in minutes

- Obtain tax information (interest paid, dividends earned)

- Access EzPay to pay all your bills, or an individual, online

- Use your Online Banking credentials to log in to our Mobile App

UFCW Mobile Banking

Visit the Apple App Store or Google Play to download our Mobile app! Log in with just a touch of your thumb, (after initial setup) or use your Online Banking credentials. Then manage all your finances directly from your phone or tablet.

You can simply and conveniently view balances or transaction history, make transfers, pay bills, and even make deposits with from your connected device. You’ll feel like you’re carrying the credit union in your pocket. (Except for the really heavy building part!)

Imagine no more trips to the Credit Union unless you need a special service or you just want to come in and say hi!

Remote Deposit Frequently Asked Questions

-

Is it secure?

-

What is Remote Deposit?

Remote Deposit is a convenient service that allows you to deposit checks to your UFCW Credit Union account remotely, using your Android or iPhone. It’s available free of charge to eligible accountholders, through the latest version of our mobile banking apps – available for free from Google Play or the App Store

-

Is there a fee?

There’s no fee for using UFCW Credit Union Mobile Banking or Remote Deposit.

-

What can I deposit using Remote Deposit?

You can use Deposit Anywhere to deposit original paper checks payable to:

- You or Cash – as the payee

- UFCW Credit Union

-

What items are ineligible for Remote Deposit

The following items can’t be deposited using Remote Deposit:

- Cash or foreign currency

- Savings bonds

- Checks payable to a third party

- Substitute checks (checks created from an electronic image)

- Checks that are irregular in any way (checks with mismatched numeric and written amounts)

- Checks that have previously been returned unpaid for any reason

- Checks that are stale dated (older than 6 months)

- Checks drawn on a foreign financial institution or payable in a foreign currency

-

Is there a limit on the amount or number of deposits?

You can deposit up to three checks per business day, totaling no more than $5,000. Business days for Remote Deposit are considered to be Monday through Friday, 8am to 3pm PST, excluding holidays or any other day we’re not open for business. Transactions processed after these hours on a business day, or on any other day that is not a business day, are treated as occurring on the next business day.

Please note that all deposits will be reviewed before final credit is issued. -

Which accounts can I deposit to?

If you meet the eligibility requirements, you can deposit to your UFCW Credit Union savings and consumer checking account.

-

Can Loan payment be made using Remote Deposit?

No, deposits can only be made into your UFCW Credit Union savings and checking accounts. However, once a deposit is made into one of those accounts, you can transfer the funds to your loan or credit card account – which is considered a payment.

-

What is the cut-off time to deposit checks?

There is no cut-off time for depositing checks through Remote Deposit. However, if you deposit your check after 3pm PST, the check will be processed the following business day.

-

How soon are my funds available?

Up to $200 will be available immediately. The remaining funds will be available by the second business day after the day of deposit. Additional delays may occur on a case-by-case basis. Business days for Remote Deposit are considered to be Monday through Friday, 8am to 3pm PST, excluding holidays or any other day we’re not open for business. Transactions processed after these hours on a business day, or on any other day that is not a business day, are treated as occurring on the next business day.

Please note that all deposits will be reviewed before final credit is issued. -

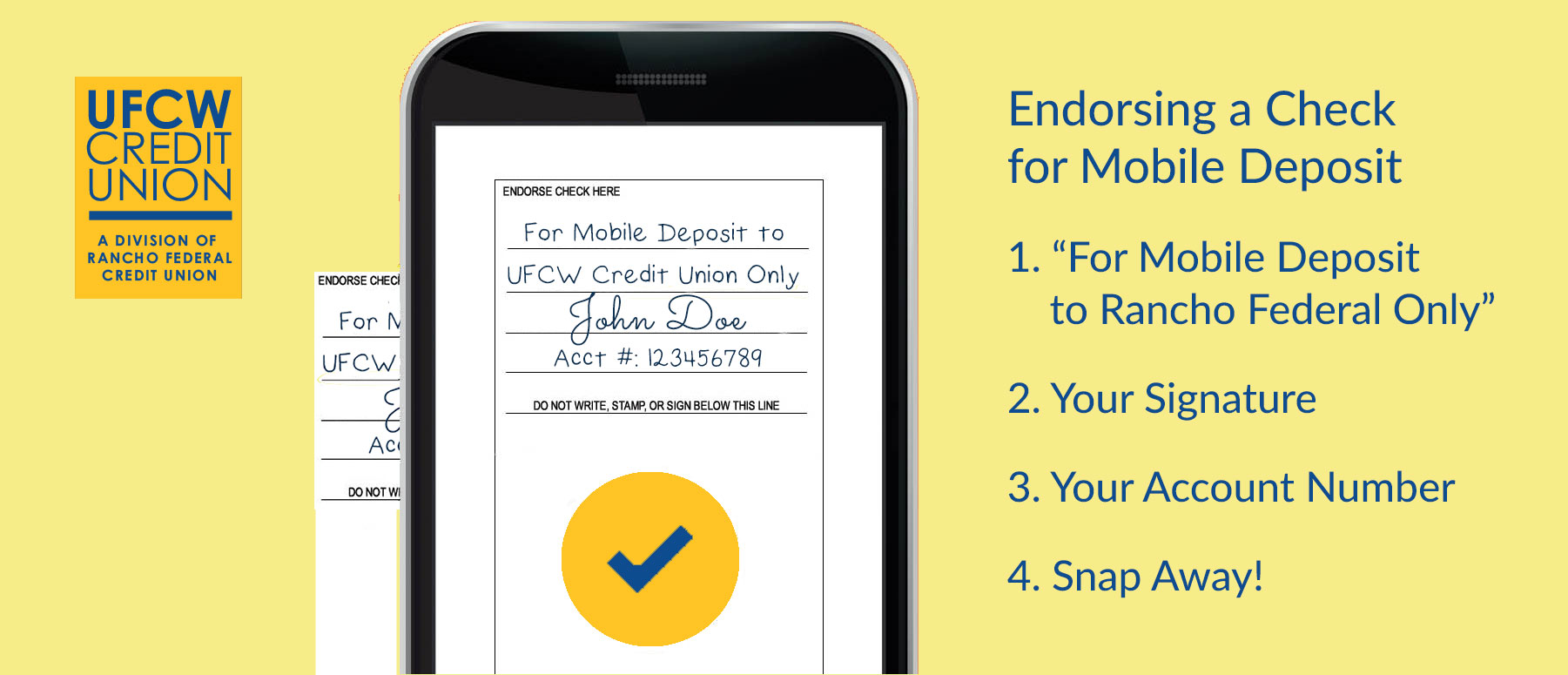

Do I need to endorse the back of the check?

Yes, as follows:

1. Write on the Back: “For Mobile Deposit to UFCW Credit Union Only”

2. Endorse the Check with your Signature

3. Write your Account Number

-

How will I know if my check was deposited successfully?

Once you’ve completed the deposit, your screen will display a confirmation message that the check was transmitted successfully. You may also log in to Online Banking to view the deposit. Please keep in mind that once the check has been successfully transmitted, it will be reviewed to ensure it can be processed. For that reason, please keep your check for 14 days before securely destroying it. You may want to maintain a separate folder for checks you’ve already deposited, so they don’t get mixed up with checks you still need to deposit.

-

What do I do with my check after I deposit it?

After your check has been successfully transmitted, it will be reviewed to ensure it can be processed. So please make a note on your check that it has been deposited and keep it for 14 days before securely destroying it. You may want to maintain a separate folder for checks you’ve already deposited, so they don’t get mixed up with checks you still need to deposit.

-

Why was my check not accepted?

If your check isn’t scanned correctly, it could be rejected for any of the following reasons:

- The MICR line (the long line of numbers toward the bottom of the check) may not be clear and within the viewer guidelines

- The check amount, number or date couldn’t be read

- The front signature wasn’t detected or was missing

- The account number, routing number or other check data couldn’t be read

- The routing number was invalid

- The check wasn’t endorsed

-

How can I ensure my check image is readable during the deposit process?

- Place the check on a dark, flat surface – free of other documents or paperwork

- Ensure that the front and back image of each check is within the borders of the screen

- Be sure the MICR line (the long line of numbers toward the bottom of the check) is fully visible

- Make sure there is space between the MICR line and the edge of the image

-

I accidentally deposited the same check at the branch or ATM, what happens now?

If you accidentally deposit the same check more than once, your account will be adjusted accordingly. It’s important that you contact the Credit Union right away to advise us of the error, to avoid any unnecessary fees and maintain your Remote Deposit privileges.

-

I have the latest app, but Remote Deposit isn’t showing up. Why?

It may be because you’re not eligible for the service. Please call us at 866.855.9050 to confirm your eligibility.

-

Why is Remote Deposit not available on my account?

It may not be available for your account if:

- You’ve been a UFCW Credit Union member for fewer than 30 days

- You aren’t registered for Online Banking

- Deposit restrictions exist on your account

- Current or previous collections exist on your account

Who can I contact if I still have questions or need assistance?

You can send us secure message, call us at 866.855.9050 or come in to our convenient branches.

iTalk Automated Phone Teller

As long as you have access to a touchtone phone, you can manage your UFCW Credit Union checking and savings accounts day or night. Just call (866) 931-7520 and enter your iTalk (formerly Rosie the Teller) access code. Follow the simple, step-by-step instructions to obtain account balances, transfer funds, make loan payments, verify whether deposits or checks have cleared and more.

• iTalk is available in both English and Spanish

• Voice Recognition: Speak your requests at any time by pressing 8*

Touch-Tone Options:

1: Account Balances

2: Account History

3: Funds Transfers and Payments (Includes immediate/scheduled transfers & payments)

4: Stop Payments and Future Dated Transactions (Includes check stops & viewing scheduled ACH/transfers)

5: Card Services (Activate, deactivate, or reorder a card)

6: Access Code Maintenance (Change Access Code)

7: Branch Information (Hours and locations)

8: Dealer Payoff Inquiries

If you like the convenience of iTalk, you’ll love our 24-hour online Online Banking service and our Mobile App. They enable you to make a wide range of secure transactions – from virtually any device with internet access. What not try one or both today?

MasterCard Debit Card

The UFCW Credit Union MasterCard Debit card is versatile and convenient. It serves as your ATM card, and can also be used to make purchases at millions of merchants worldwide, wherever MasterCard is accepted. It is faster and easier than writing checks and each transaction is deducted from your checking account and itemized on your statement. Best of all, you never pay a finance charge or annual fee.

If your card has been lost or stolen call the Rosie the Phone Teller number 562-803-0329. It will prompt you with the following:

After salutation:

- For Main Menu of services press 1

- To Activate a New Card press 2

- To report a card lost, stolen or not received press 3

- To block a specific card number press 1

- To block all cards on account press 2

- Then enter the card information.

If the Credit Union is open please contact a representative.

Bill Pay

Save time and postage with Bill Pay. There is NO FEE to use this service, all you need is a UFCW Credit Union checking account in order to start saving time and money! Bill Pay is conveniently located inside of our Online Banking service.

- Pay an unlimited number of bills each month

- Set up single or recurring payments

- Deduct payments from your UFCW Checking Account

- Access E-bills online from your payees

- Receive an e-mail when each e-bill arrives

- Pay individuals, such as gardeners, house cleaners or babysitters

If you have any questions regarding Bill Pay please contact the following:

Phone (562) 803-6401 or (866) 855-9050

Hours Monday – Thursday 9am to 4pm and Friday 8am to 6pm.

Email: memserv@ranchofcu.org

Auto Locating and Buying Services

UFCW Credit Union has partnered with GrooveCar for locating and buying cars, depending on how involved you would like to be in the process. Visit groovecar.com to research just the right car, truck, van or SUV for your family. Then find a match for that vehicle near you in three simple steps. We call it Find, Drive and Save, and that’s just what you’ll do!

If you have any questions regarding GrooveCar, please contact our Loan Dept:

Phone (562) 803-6401 or (866) 855-9050 ext 2

Monday – Friday 9am to 4pm

Insurance Services

UFCW Credit Union offers access to a wide range of insurance products and services to protect you and your family. We offer Credit Life and Credit Disability Insurance, with low premiums included in your monthly auto loan payments, plus Mechanical Breakdown Insurance (MBI) and Guaranteed Asset Protection (GAP) to protect your investments in motor vehicles. Accidental Death and Dismemberment (AD&D), Life, Auto and Homeowners Insurance are available through TruStage. More about TruStage below.

TruStage Insurance

TruStage Insurance: Simple, Straightforward, Budget-Friendly.

Insurance is an important part of a solid financial plan. The key is finding coverage that fits your needs and budget from someone you can trust. The right insurance can help give you peace of mind.

Backed by more than 80 years of working with credit unions and their members, you can count on TruStage to help protect what matters most. Trust us for all your insurance needs, including life, health, car and home, accidental death and dismemberment coverage and more. Get a quote or explore your options at TruStage Insurance.

© Copyright 2024, TruStage. All Rights Reserved.

TruStage® insurance products and programs are made available through TruStage Insurance Agency, LLC. Life insurance and AD&D insurance are issued by CMFG Life Insurance Company, PO Box 61, Waverly IA 50677-0061. Auto and Home Insurance Program are issued by leading insurance companies. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union.

Wire Transfers

Wire transfers are a form of electronic payment service that enable you to receive or send money from one financial institution to another quickly and securely.

To receive an incoming wire transfer, provide the information shown below to the sender.

To send an outgoing wire transfer, download the fillable Wire Transfer Initiation form here.

The price of your wire transfer will depend on whether it is incoming or outgoing, and whether the transaction is domestic or international.

Wire to:

ABA/Routing # 271987635

Receiving Institution:

Alloya Corporate Credit Union

4450 Weaver Parkway, Suite 100

Warrenville, IL 60555

Further Credit:

UFCW

12620 Erickson Ave., Suite H

Downey, CA 90242

Account #: 322275144

Final Credit:

Members Name

Members Address

Members Account # (UFCW Credit Union)

You may contact one of our Member Services Representatives at your local branch below if you have any further questions.

Direct Deposit

After a simple, one-time enrollment, you can have your net paycheck routed to your UFCW Credit Union checking account, automatically every payday. Your funds are available the same day at any UFCW Credit Union branch office, at the ATM or on our Online Banking online service. You may also choose payroll deduction to make loan or credit card payments automatically. Use UFCW Credit Union’s routing number 3222-7514-4 and your account number for direct deposits, payroll deductions and other electronic transfers (EFTs). To set up Direct Deposit of your Social Security checks, call (800) 772-1213 or go to www.ssa.gov/deposit/howtosign.htm. Think of all the time you’ll save.